Trends

Trends

MAY

22

2023

Environment

Identify, measure, act

Our daily life depends to a large extent on the resources that nature provides us with – water, air, geological resources, pollination, and so on. According to a World Economic Forum report, more than half of the world’s Gross Domestic Product (GDP) depends to some extent on nature. We see this clearly in agriculture or food, but the tourism industry or telecommunications also depend on these resources.

The concept of “Natural Capital” was first coined in 1973 by British economist Ernst Friedrich Schumacher in his book “Small is Beautiful. A Study of Economics as if People Mattered”. In a complicated European economic context marked by the oil crisis, generalised inflation, rising prices, and other factors, this author began to envisage that both financial capital and natural capital should be considered for economic development. He was referring to natural resources like water, air, soil, biodiversity and other resources necessary for sustaining human life and well-being.

Since then, the concept of “Natural Capital” has been used to describe the importance of conservation and sustainable management of natural resources in the context of economic development. Analysing this helps us to understand the value and importance of these natural resources in relation to our economic activities.

The concept gained even more traction with the signing of the United Nations Natural Capital Declaration in 2012 and the Natural Capital protocol signed in 2016, which provides a clear and consistent methodology for measuring and evaluating the natural capital of a company or region, allowing better decision-making and more sustainable management of natural resources.

Natural capital applied to a business context refers to the natural resources required for that company to operate, but also to the impact generated by its activity. For example, a company that sells shoes must take into account the materials needed to produce them: leather and rubber. Leather is extracted from cows, which need grass and cereals to feed on, which in turn need water and land to be cultivated. The rubber for the soles is obtained from trees, which need soil and water to grow. But to sell the shoes, the company also needs shops, which need light, heating, and so on. The paradigm shift in business mentality has involved not only identifying the business’s impact on natural capital, but quantifying to do such things as performing preventive actions if drought is making the trees that produce rubber unable to grow at the rate the company needs.

The American chemical company Dow Chemical was one of the first companies to incorporate natural capital into its business practices. In 1996, it assessed and measured the company’s impacts and dependencies on natural capital, and consequently adopted several policies and practices with an integrated and sustainable approach to business management, while considering the importance of natural capital for the long-term success of the company: improving energy efficiency and water use in operations, setting targets for reducing waste and greenhouse gas emissions, etc.

Other companies such as Puma, Unilever, Coca-Cola or Nestlé have also studied the impact of their activities in relation to natural capital. For example, with its “Cultivating Sustainability” programme, Nestlé has focused on improving the company’s supply chain, while Unilever has focused on improving the health of the soil in the areas where the company obtains its raw materials, among other aspects.

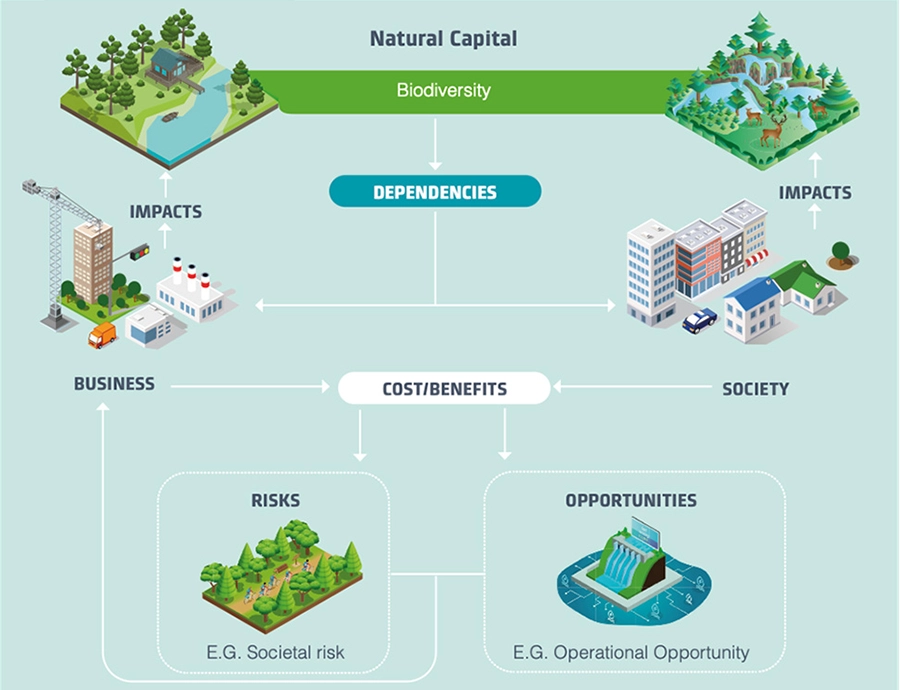

Cellnex, which has more than 135,000 sites including forecast roll-outs up to 2030 in urban and rural areas throughout 12 European countries, is running a project that analyses the organisation’s interaction with natural capital in terms of dependencies and impacts, considering direct and indirect economic activities throughout its entire value chain. The dependency analysis highlights the importance of maintaining habitats in a good state of conservation so that species can play their role, mitigating any negative effects linked to soil erosion and climate variability that give rise to extreme natural phenomena which have an impact on the assets of the organisation.

The impact analysis involved determining which activities have the greatest impact on biodiversity. The 2022 Environment and Climate Change Report lists these activities, which include generation of CO2 or waste, among others. Equipped with this information, the company can apply changes and activate policies to better focus its efforts. An analysis of dependencies and impacts in the company context makes it possible to identify the risks and opportunities related to natural capital.

Cellnex has also preliminarily identified which physical and transition risks it must take into consideration in its interaction with natural capital, following the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD). In the Environment and Climate Change Report and in the section dedicated to nature and biodiversity of its 2022 Annual Report, Cellnex highlights the increase in the number of fires as one of the greatest risks, since it can affect the company’s assets. Hence the importance of proper management of the surrounding vegetation. Also in relation to the climate, meteorological conditions, specifically the increase in rainfall or severe storms, can cause extreme gusts of wind that cause the towers to collapse. As regards transition risks, we have identified reputational, market, technological and regulatory risks that must be observed carefully to prevent any involvement.

The next step in the analysis involves quantifying the financial impact of including natural capital in the organisation. To this end, it will continue to work to align its accounting to one of the existing international standards such as ISO 14007:2019 (Environmental Management), ISO 14008:2019 (Monetary valuation of impacts and related environmental aspects) or Natural Capital Accounting (BSI). In parallel, it will develop the provisions of the TNFD framework for quantifying the risks and opportunities identified from the analysis of natural capital in the context of the organisation.

Developing these frameworks and standards will allow Cellnex to set goals for reducing biodiversity impacts and develop future actions focused on the application of the No Net Loss principle in the priority areas identified in the nature-based risk analysis and to protect, conserve and restore ecosystems in which it has contributed to habitat degradation following the mitigation hierarchy.

Yolanda Romero

Sustainability Project Manager