Mediacenter

- 05 Mar 2024

- ·

- Corporate

Cellnex Telecom Capital Markets Day

Updates on Next Chapter strategy centred on four strategic pillars

New leverage target and new approach to shareholder remuneration policy

New guidance disclosed up to 2027

London and Barcelona, 5 March 2024. Cellnex Telecom (“Cellnex” or “the Company”), Europe’s largest operator of wireless telecommunications infrastructure, presents today its Capital Markets Day in London, UK and online here.

Cellnex’s Chairperson, Anne Bouverot, along with the Executive Leadership Team –Marco Patuano, CEO; Vincent Cuvillier, CSO; Simone Battiferri, COO; Raimon Trias, CFO; and Juan José Gaitán, Head of Investor Relations– will share updates on the next stage of Cellnex’s growth strategy and the path to achieve new short and medium-term financial targets.

The event will begin promptly at 13:00 GMT. Access instructions and materials are available on Cellnex’s Capital Markets Day as well as Investor Relations website.

Next Chapter of Cellnex’s strategy

“The growing demand for connectivity in Europe demonstrates Cellnex’s vital role as an efficient and neutral infrastructure platform, helping our customers with their infrastructure deployments while taking into account the environmental impacts. With an experienced and energised management team, Cellnex has an ambitious roadmap for growth and value creation that is fully supported by the Board of Directors,” said Anne Bouverot, Chair of Cellnex’s Board of Directors.

“We are embarking on the next chapter of Cellnex’s growth, building on the solid foundation since our IPO in 2015. Guided by a strong commitment to our customers, our shareholders, and sustainability, we are now focused on improving efficiency, simplifying the portfolio and the business, and capturing essential growth opportunities,” said Marco Patuano, CEO of Cellnex. “This new approach will allow us to balance investments and return significantly more cash to shareholders from 2026 onwards, while strengthening our position as Europe’s leading independent tower company.”

Following a period of extraordinary growth since its IPO in 2015, Cellnex in 2022 committed to a new business strategy focused on strengthening the company’s balance sheet, securing an Investment Grade rating (BBB-) from Standard & Poor’s, accelerating the company’s organic growth, and generating net positive cash flow from 2024, the latter has already been achieved in 2023.

Building on the progress made towards this strategy, Cellnex is today updating the next chapter of this growth story, centred around four strategic pillars:

- Simple: Cellnex is undertaking a strategic portfolio review to focus on core markets and businesses and divest from non-core business lines that exhibit limited growth potential for the company. The aim is to reduce operational complexity, strength the balance sheet, and enhance the credit rating, laying the ground for stronger results and future organic expansion, boosting an improvement in the shareholders return.

- Focused: Cellnex aims to prioritise co-tenancy growth, complemented by Build-to-Suit (BTS) projects for its customer. The goal is to achieve a tenancy ratio of 1.64 in 2027 to maximise the value of existing assets. While towers remains the core part of the business, Cellnex will invest in selected business lines – DAS (Distributed Antenna Systems), SCs (Small Cells) & RAN (Radio Access Network) as a service; and wholesale fibre, connectivity & housing services – aiming to grow these from 11% to 15% of total revenues by 2027.

- Efficient: The company will launch a comprehensive efficiency plan to improve the EBITDAaL margin by 500 basis points to 64% in 2027. This will be achieved by a combination of optimising lease costs, segmenting the tower portfolio, improving efficiency in operations and management, as well as driving digital transformation and improvements in productivity. The lease cost optimization will be pursued through the creation of a dedicated vehicle specialized in the land acquisition in selected countries; the vehicle will initially count on 10,000 sites and the potential entry of minority investors has not been ruled out.

- Responsible: Cellnex remains steadfast in its commitment to strong governance and the incorporation of Environmental, Social, and Governance (ESG) principles within its strategic framework. The company is dedicated to achieving its ESG Strategy 2025 targets and to fostering continuous improvement, consolidating its leading position as one of the most sustainable telecoms infrastructure operator globally.

Short and medium term guidance

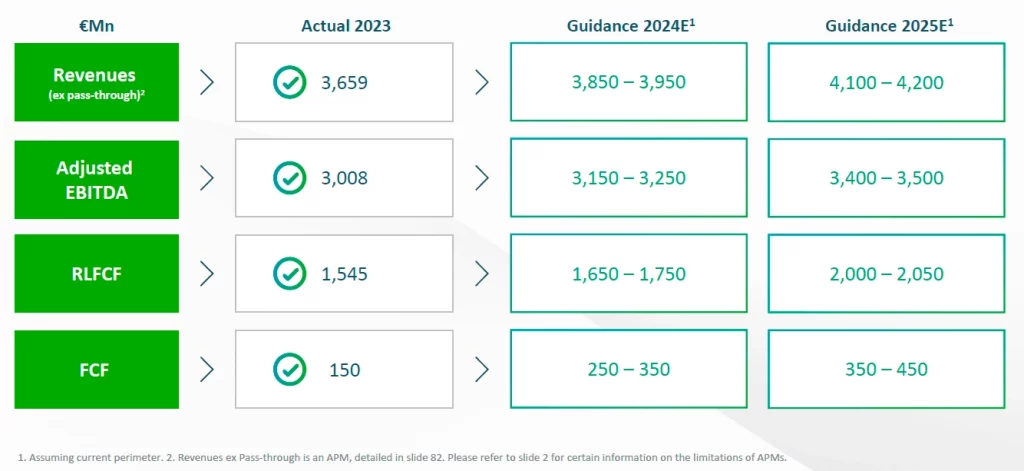

Cellnex is reiterating its commitment to its 2025 guidance and is disclosing a new guidance for 2024 and a medium term guidance for 2027.

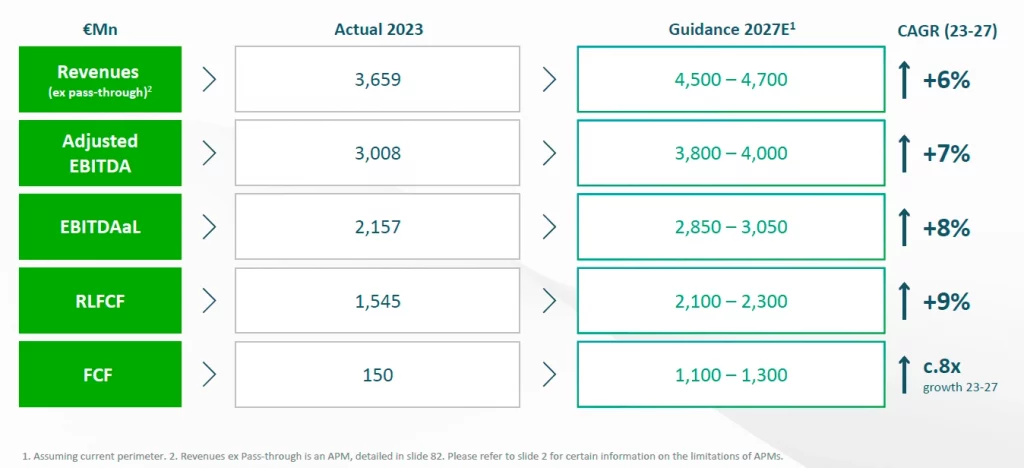

The company anticipates revenues, excluding pass-through, to reach EUR 4.5-4.7 billion by 2027, reflecting the strong backlog and co-location trends. Adjusted EBITDA is expected to improve to EUR 3.8-4.0 billion and EBITDAaL of EUR 2.85-3.05 billion, driven by reductions in operational complexity. Reflecting Cellnex’s continued robust operational performance, the Recurring Levered Free Cashflow (RLFCF) is forecast to be between EUR 2.1-2.3 billion while free cashflow (FCF) is EUR 1.1 and 1.3 billion.

Cellnex will also unveil an improved financial reporting framework with more granular detail across business lines, including reporting on four business lines (up from three) and excluding pass-through costs from revenues. Cellnex will report revenues and adjusted EBITDA for the top five countries (up from three) and include more granular detail on CapEx.

New capital allocation framework, leverage target and new approach to shareholder remuneration policy

Cellnex will adopt a clear and disciplined capital allocation framework aimed at significantly increasing shareholder returns. After achieving investment grade in 2024 (target confirmed) the medium/long term Cellnex’s new leverage target will be of 5.0-6.0x Net Debt / EBITDA IFRS 16, giving the company additional resources to allocate to the shareholder remuneration and/or industrial growth. The proposed range will allow Cellnex to have the flexibility needed to adapt its strategy to different external scenarios, while remaining consistent with the commitment to investment grade.

With EUR 10 billion in planned available cash by 2030, the new capital allocation will balance a combination of profit distribution via dividends (minimum of EUR 3 billion in dividends between 2026 and 2030), and/or share buybacks as well as investments in industrial growth opportunities (up to EUR 7 billion).

Starting from 2026, shareholders can expect a minimum dividend payment of EUR 500 million a year, with a minimum annual grow rate of 7.5% in the years to follow. Cellnex may consider earlier share buybacks and/or dividend payments contingent upon its leverage and rating.

Future industrial growth opportunities will be subject to clear return criteria, based on a minimum equity Internal Rate of Return (IRR), tailored to the investment risk profile.

About Cellnex Telecom

Cellnex is Europe’s largest independent operator of wireless telecommunications infrastructure, providing telecom operators access to a wide network of telecommunications infrastructure on a shared-use basis, contributing to reduce access barriers and improving services in the most remote areas. The company manages a portfolio of 138,000 sites, including planned rollouts up to 2030, across 12 European countries, with significant presence in Spain, France, the United Kingdom, Italy, and Poland. Listed on the Spanish stock exchange, Cellnex is a constituent of the IBEX 35 and EuroStoxx 100 indices and holds relevant positions in major sustainability indexes, including CDP, Sustainalytics, FTSE4Good, MSCI and DJSI Europe.