Trends

Trends

AUG

02

2022

DAS & Small Cells

Significant growth in small cell deployment

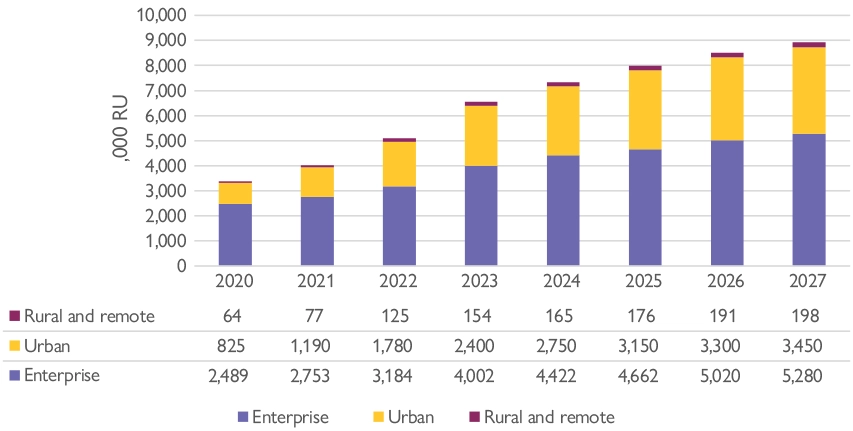

Manufacturing, utilities, energy, retail and transportation industries will be the biggest deployers of small cells in the period 2020-27.

Small Cell Forum (SCF), the global membership organization committed to supporting agile, low-cost mobile infrastructure through small cells, has released its latest market forecast report, available here, based on a survey of 101 service providers. The report confirms the continuing growth of the small cell market, while forecasting that 2022-27 will be a period of rapid change and expansion in the small cell market, driven by potent enablers that include increased diversity in use cases, deployment business models and architectures.

Caroline Gabriel, SCF Content Director, says: “Our survey tells us that open networks, shared spectrum and new operating models have the potential to drive significant growth in small cell rollout. However, this growth is reliant on several key challenges being addressed as a matter of urgency: siting and regulation, 5G, shared spectrum… Common foundations on which vendors and operators can innovate in a unified and interoperable way will be the biggest single factor in ensuring that the small cell industry meets or exceeds the growth predicted in this forecast.”

Key data points

- The report forecasts compound annual growth rate (CAGR) for small cells of 15% for the whole global market, which will result in cumulative deployments of almost 36 million radios by 2027.

- Manufacturing, utilities and energy, retail and transportation industries will be the biggest deployers of small cells in the period 2020-27, reflecting the large numbers of units they will need to support very large premises or infrastructure networks.

- By 2027, the number of units deployed and run by neutral hosts will match the number deployed and run by private network operators (PNOs), at about one-third each. From 2023-27, PNOs will be the largest category of small cell operator, overtaking MNOs’ public networks from 2023.

- The percentage of new small cells that will be deployed with 5G New Radio, or 4G/5G, support will rise from 13% in 2020 to 96% in 2027.

- Deployment of Open RAN small cells will rise at a CAGR of 146% in 2021-27, to reach 51% of total small cells deployed at the end of that period, and a rollout rate of 2.7 million radio units in enterprise and private environments, and 1.8 million in public networks.

- APAC will account for about 55% of total deployments throughout the forecast period; Europe will grow at 15% CAGR; deployments in the rest-of-the-world category will rise, from a smaller base, at 39% CAGR. North America, a very important driver of small cell rollout in the 2010s, will see its annual deployments peak in 2023, though it will still account for 13% of global deployments in 2027.

Key themes

Five key trends emerged more strongly than any others, in shaping deployment and commercialization strategies for the early- to mid-2020s. These are:

- The diversity of use cases will require common foundations to avoid fragmentation

- The wide variety of enterprise 5G requirements will require many deployment models

- Migration to 5G is driving architecture evolution, often led by small cells

- Open RAN is taking a central role in the migration to new 5G architectures

- Spectrum bands and licences must diversify too, with support from progressive regulations

Prabhakar Chitrapu, Chair, Small Cell Forum, says: “The results from this year’s survey make compelling reading. Service providers are clear that the wide variety of enterprise 5G requirements demand many deployment models. To meet that demand, architectural change will not be sufficient on its own. There will need to be a far greater diversity of deployment and monetization models than exists for mobile broadband.”

Now in its seventh year, SCF’s Market Status Report is based on service provider surveys, modelling and forecasts. Completed in the first half of 2022, survey respondents comprised a total of 69 tier 1 and 2 mobile-only or fixed/mobile operators, along with 32 other organizations planning or deploying cellular networks, including neutral host providers, private network operators and enterprise service providers.